Launch Your Business with Confidence

Starting a business? We're here for you every step of the journey. From company formation to compliance, we've got your back. Let’s get it right, from the start.

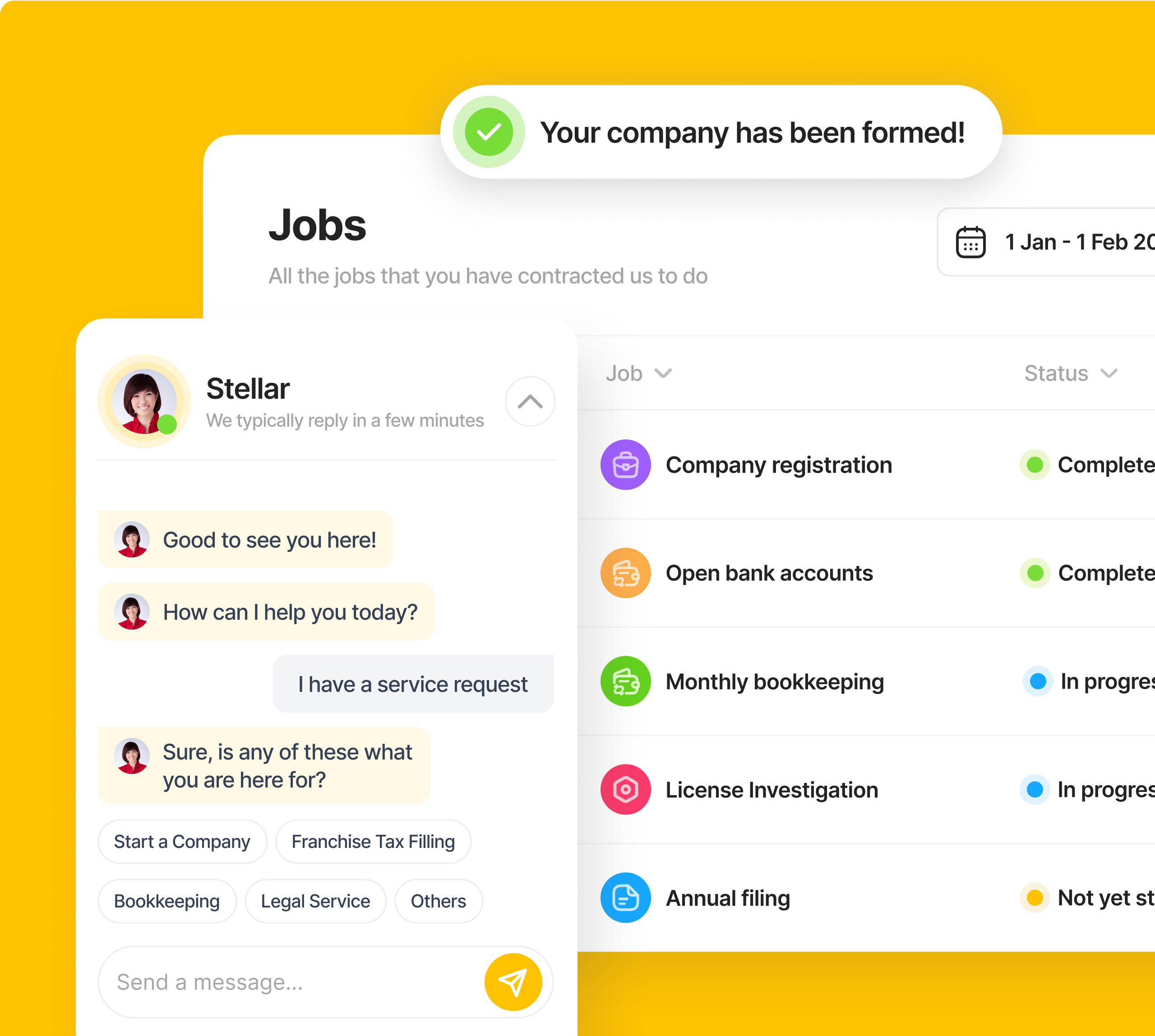

We take care of the critical (but boring) tasks so you don’t have to.

Building and managing a business is one of the hardest things one can do. We want to make it easier for you.

Our solutions simplify the entire process, from company registration to ongoing compliance requirements.

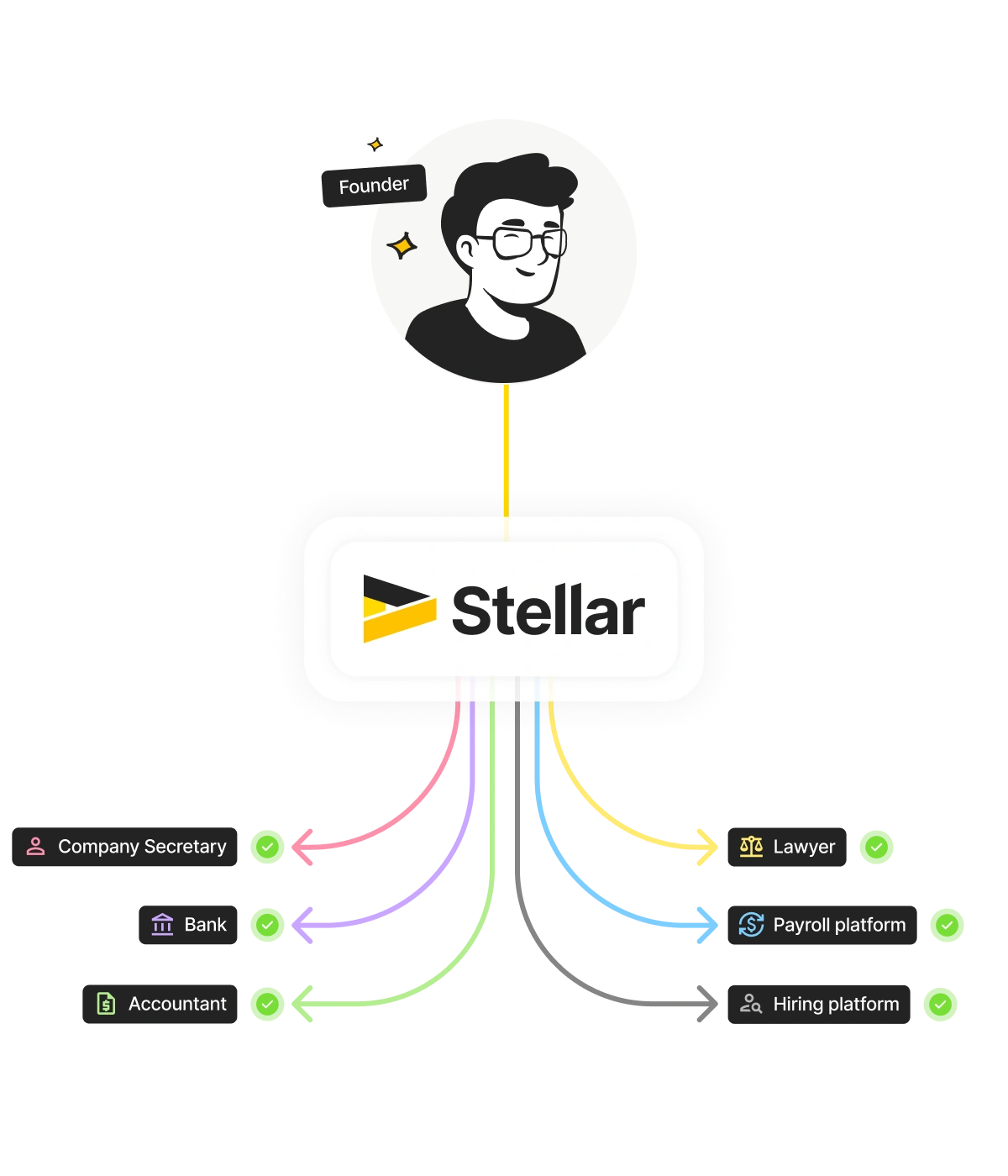

We don’t just set up your business for you – we build it with you.

You focus on winning customers and growth, let us take care of the rest.

We are not your typical suit-and-tie corporate drones. Our mission?

Making it surprisingly easy to start and scale your company.

We’ve unified all company back office operations into one efficient platform.

.webp)

.webp)

.png)

Starting a business? We're here for you every step of the journey. From company formation to compliance, we've got your back. Let’s get it right, from the start.

Talk to us to find out more